Beatrice Fox Auerbach Computer and Administration Center (Room 123)

Business hours: Monday through Friday, 8 a.m.–4 p.m.

Phone: 860.768.4579

Email: payroll@hartford.edu

Fax: 860.768.5051

The mission of the Payroll Department is to provide timely and accurate payments to all University of Hartford faculty, staff, and student employees by following the policies, procedures, and regulations set forth by the University, the State, and the federal government. We focus on providing quality customer service and support to the University community, state and federal agencies, and the public.

The University Payroll Department is located in the FASB building. Business hours are Monday through Friday, 8:00 a.m.– 4:00 p.m.

The primary function of the Payroll Department is processing biweekly and semi-monthly payments to employees of the University. Other services include preparing W-2 forms and related employment tax returns.

Employees may contact the department with questions regarding their pay and W2s.

As of July 1, 2017, the Human Resource Department and the Payroll Office underwent a Banner revitalization project. The revitalization created a Semi-Monthly pay cycle and change in the way time was reported. In addition, roles and responsibilities were reassessed.

The most noticeable is that there will be a Bi-Weekly and a Semi-Monthly payroll cycle. The Bi-weekly will be for Non-Exempt Employees reporting their time through Banner Web Time Entry(which can be access from on or off campus) or Kronos Work Force Ready. The Semi-Monthly will be for Exempt Employees, where they will only be using Leave Report, only required to report time off. Payroll Calendars can be found within the Payroll website. It is recommended that you review your tax withholdings and deductions due to these changes.

Other changes include that all deductions, tax forms and direct deposit forms are maintained by the Human Resource Department, many of which can be done through Employee self service. Budget questions are to be addressed with Budget Office.

Web Time Entry – Timesheets and Leave

The University is using Banner’s Web Time Entry. This is accessed through employee Self-Service using any device that has Internet connectivity, on and off campus. Bi-Weekly employees using Web Time Entry will use “Timesheet”, Semi-Monthly Employees that accrue time off, will be using “Leave Report”.

Bi-weekly employees that are using Web Time Entry are responsible to record their time on a daily basis, as per the employee staff manual. Employee timesheets must be submitted for approval by 11 a.m., Monday of the pay week. Their Approver has until 1 p.m. that day, to approve the timesheet.

An automated email will be sent to all employees in the morning of Friday (week prior) and Monday (week of) with a timesheet deadline remind as long as their timesheet is “in progress”. If you do not start your timesheet, you will not receive the automated reminder.

Timesheets that were not submitted timely will be paid on the next scheduled payroll cycle.

Employee directions: Hourly Employee Time Entry Process (PDF)

Approver directions: Supervisor Approval Process (PDF)

Proxy Directions (Self Service 9): Acting As a Proxy (PDF)

Reminder for student workers

As a reminder for student workers (Federal Work Study and University Work Study) and their approvers:

Federal Work Study (FWS) students can only work between the 1st day of classes to the last day of final exams and their position must be active. Working during the winter break and spring break, they should seek approval. This position may not work more than 24 hours in a work week at any point during the school year. While the school year is in session, you may not work more than 24 hours, all campus jobs (FWS and UWS) combined. The timesheet “SHIFT” column will always be 1.

University Work Study (UWS) students can only work when their position is active. While the school year is in session, you may not work more than 24 hours, all campus jobs (FWS and UWS) combined. During winter and summer break, you may work more than 24 hours and must record time as overtime, when you work more than 40 hours in a work week. The timesheet “SHIFT” column will always be 1.

Approvers for student workers please take notice: As the approver (and this applies to all approvers), you are responsible to ensure that your students are submitting their hours worked in a timely manner with the deadlines mentioned above.

At the end of every fiscal year, the UWS jobs are automatically ended and it is the approvers responsibility to re-activate these jobs to work in the new fiscal year. If needed, you may terminate jobs before then. Any questions on job terminations/reactivations, please contact your human resources representative.

Exempt employees can start entering their Leave Report time as soon as the 1st day of that pay period in which time is taken. The employee will be able to enter that time over the course of that pay period and the following two pay periods (roughly 30 days). The approver has 5 additional calendar days to approve the employee’s time.

We do recommend that the employee submit their time once the period has ended to make sure no changes are needed.

Example: Employee takes Vacation time on July 9th, they can record that leave time when the pay period starts on July 1st and they have until August 15th to submit that time for approval. The Approver then has 5 additional calendar days from the employee’s deadline to approve the Leave Report, which would be August 20th.

Directions: Exempt Staff Leave Reporting (PDF)

Non-Exempt (Bi-weekly):

You can log into Self-Service, Employee Tab, Leave Balances and then select which Leave type you want to see and it will show you how much has been approved by pay period.

Your balance is updated through payroll processing of the most recent check date.

Exempt (Semi-Monthly):

You can log into Self-Service, Employee Tab, Leave Balances and then select which Leave type you want to see and it will show you how much has been approved by pay period.

Your balance is up to date as long as all your entries in Leave Report are “Complete”. In Leave Report when you look at the date drop down box, the date must say “Completed” (Approver has approved time) next to it, for the balance to be reduced.

Fiscal Year 2025-26: Bi-Weekly Payroll Calendar

| Pay # | Start Date | End Date | Check Date |

|---|---|---|---|

| 14 | 6/16/2025 | 6/29/2025 | 7/3/2025 |

| 15 | 6/30/2025 | 7/13/2025 | 7/18/2025 |

| 16 | 7/14/2025 | 7/27/2025 | 8/1/2025 |

| 17 | 7/28/2025 | 8/10/2025 | 8/15/2025 |

| 18 | 8/11/2025 | 8/24/2025 | 8/29/2025 |

| 19 | 8/25/2025 | 9/7/2025 | 9/12/2025 |

| 20 | 9/8/2025 | 9/21/2025 | 9/26/2025 |

| 21 | 9/22/2025 | 10/5/2025 | 10/10/2025 |

| 22 | 10/6/2025 | 10/19/2025 | 10/24/2025 |

| 23 | 10/20/2025 | 11/2/2025 | 11/7/2025 |

| 24 | 11/3/2025 | 11/16/2025 | 11/21/2025 |

| 25 | 11/17/2025 | 11/30/2025 | 12/5/2025 |

| 26* | 12/1/2025 | 12/14/2025 | 12/19/2025 |

| 1 | 12/15/2025 | 12/28/2025 | 1/2/2026 |

| 2 | 12/29/2025 | 1/11/2026 | 1/16/2026 |

| 3 | 1/12/2026 | 1/25/2026 | 1/30/2026 |

| 4 | 1/26/2026 | 2/8/2026 | 2/13/2026 |

| 5 | 2/9/2026 | 2/22/2026 | 2/27/2026 |

| 6 | 2/23/2026 | 3/8/2026 | 3/13/2026 |

| 7 | 3/9/2026 | 3/22/2026 | 3/27/2026 |

| 8 | 3/23/2026 | 4/5/2026 | 4/10/2026 |

| 9 | 4/6/2026 | 4/19/2026 | 4/24/2026 |

| 10 | 4/20/2026 | 5/3/2026 | 5/8/2026 |

| 11 | 5/4/2026 | 5/17/2026 | 5/22/2026 |

| 12 | 5/18/2026 | 5/31/2026 | 6/5/2026 |

| 13 | 6/1/2026 | 6/14/2026 | 6/18/2026 |

| 14 | 6/15/2026 | 6/28/2026 | 7/2/2026 |

Fiscal Year 2025-26: Semi-Monthly Payroll Calendar

| Pay # | Faculty 20 Pay | Adjunct | Start Date | End Date | Check Date |

|---|---|---|---|---|---|

| 13 | SU | 7/1/2025 | 7/15/2025 | 7/15/2025 | |

| 14 | SU | 7/16/2025 | 7/31/2025 | 7/31/2025 | |

| 15 | SU | 8/1/2025 | 8/15/2025 | 8/15/2025 | |

| 16 | * | SU | 8/16/2025 | 8/31/2025 | 8/29/2025 |

| 17 | * | F | 9/1/2025 | 9/15/2025 | 9/15/2025 |

| 18 | * | F | 9/16/2025 | 9/30/2025 | 9/30/2025 |

| 19 | * | F | 10/1/2025 | 10/15/2025 | 10/15/2025 |

| 20 | * | F | 10/16/2024 | 10/31/2025 | 10/31/2025 |

| 21 | * | F | 11/1/2025 | 11/15/2025 | 11/14/2025 |

| 22 | * | F | 11/16/2025 | 11/30/2025 | 11/26/2025 |

| 23 | * | F | 12/1/2025 | 12/15/2025 | 12/15/2025 |

| 24 | * | 12/16/2025 | 12/31/2025 | 12/31/2025 | |

| 1 | * | W | 1/1/2026 | 1/15/2026 | 1/15/2026 |

| 2 | * | 1/16/2026 | 1/31/2026 | 1/30/2026 | |

| 3 | * | S | 2/1/2026 | 2/15/2026 | 2/13/2026 |

| 4 | * | S | 2/16/2026 | 2/28/2026 | 2/27/2026 |

| 5 | * | S | 3/1/2026 | 3/15/2026 | 3/13/2026 |

| 6 | * | S | 3/16/2026 | 3/31/2026 | 3/31/2026 |

| 7 | * | S | 4/1/2026 | 4/15/2026 | 4/15/2026 |

| 8 | * | S | 4/16/2026 | 4/30/2026 | 4/30/2026 |

| 9 | * | S | 5/1/2026 | 5/15/2026 | 5/15/2026 |

| 10 | * | SU | 5/16/2026 | 5/31/2026 | 5/29/2026 |

| 11 | * | SU | 6/1/2026 | 6/15/2026 | 6/15/2026 |

| 12 | SU | 6/16/2026 | 6/30/2026 | 6/30/2026 | |

| 13 | SU | 7/1/2026 | 7/15/2026 | 7/15/2026 |

Download Payroll Calendars

Download and print payroll calendars.

Semi-Monthly Calendar for 2025-26 (PDF)

Bi-Weekly Calendar for 2025-26 (PDF)

Past year:

Semi-Monthly Calendar for 2024-25 (PDF)

Bi-Weekly Calendar for 2024-25 (PDF)

Direct Deposit

What Is Direct Deposit?

Direct deposit is the electronic transfer of a payment directly from the account of the payer to the recipient's account. Direct deposit is a safe and easy way to have your salary deposited directly into your checking or savings account into bank accounts of your choice.

As a reminder, Direct Deposit is condition of employment and that all live payroll checks are mailed, you may want to consider updating your Payroll Address with the Human Resources Department.

Benefits of Direct Deposit

-

It's convenient—no more trips to the bank.

-

It's safe and reliable—protects against the loss or theft of checks.

-

You can still access your funds, even if you're out of town, sick, or busy.

-

It helps you manage your money—you may have your paycheck deposited into multiple accounts.

How Do I use Direct Deposit?

To establish a direct deposit account and return to the Human Resources Department, you will need to set up your banking information in Self-Service.

The following bank information is required:

-

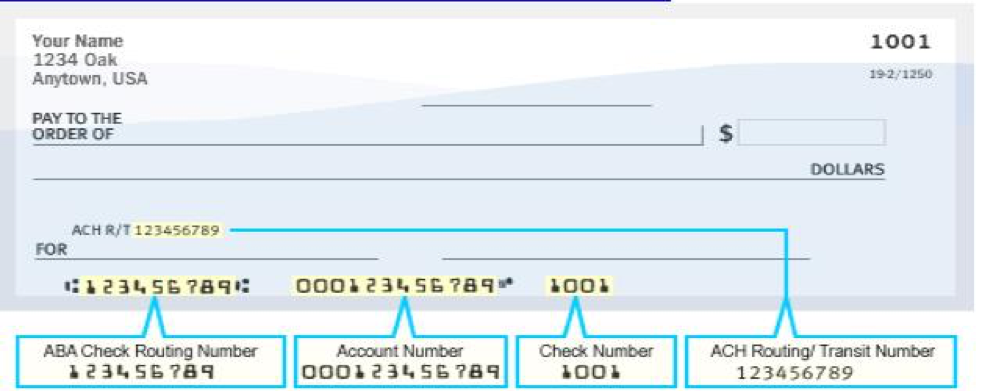

ABA Routing number: Bank routing number or routing transit number (RTN) is a nine digit number used to identify a financial institution. The routing number appears at the bottom of your bank-issued checks. They can also be found on online banking sites of the financial institution. Please contact your financial institution if you are unsure of your routing number.

-

Account number: Your complete account number(s)

-

Account type: Indicate checking or savings account.

Sample of check identifying the transit routing number:

Pre-note process:

A pre-note process is required by the bank for each new direct deposit account that is recorded in the system. During this period a paper check will be issued while the account is tested. Direct deposit will usually start within one to two pay periods. A direct deposit advice that details your gross pay, associated deductions, and net amount deposited to your bank account is available online via the Employee Self-Service Center.

Stopping a Direct Deposit

If necessary, notify the Payroll Department immediately to stop direct deposit for an upcoming payment. A new direct deposit authorization form request must be presented to the Human Resources Department for any changes. Any questions, please contact the Human Resources Department.

Please note: If you close an account before your banking information has been updated with Human Resources, payment may be delayed while funds are recovered. Direct Deposit funds returned from the bank are paid to the employee on their next scheduled pay cycle.

Direct deposit remains in effect until you request to inactivate it. You may inactivate your bank accounts by completing the direct deposit form and returning the form to the Human Resources Department.

Changing a Direct Deposit

Changes to direct deposit accounts generally take one to two pay periods to process. An actual check will be issued between the inactivation of your current and the activation of your new account unless you choose to waive the pre-note process.

Reporting Accounts Closed Due to Fraudulent Activity

Contact the Payroll Department immediately if your bank account(s) must be closed due to fraudulent account activity.

As of April 1, 2013, Direct Deposit is mandatory for all employees. Checks are produced for the pre-notification process of direct deposit.

As of April 2018, all Live checks will be mailed to your Payroll Address on file.

Additional Information

Employees may update an address, telephone number, name, marital status, or emergency contact by contacting the Human Resources Development office. Your change will update payroll and personnel files.

I-9 (PDF) Under the Immigration and Nationality Act, you must verify the identity and employment eligibility of anyone you hire for employment in the United States. This includes citizens and non-citizens alike. The Employment Eligibility Verification Form I-9 (PDF) was developed by the Immigration and Naturalization Service (INS) for verifying that persons are eligible to work in the United States. Please contact Human Resources Development office for further information.

The Federal Form W-4, Employee’s Withholding Allowance Certificate, as well as CT state W4 elections, has been made available to update through employee Self-Service. Click here for more information on employee Self Service Center (PDF).

Employees who claimed exempt status in the previous year and wish to continue their exemption for the current year must submit a new Form W-4 through Employee Self Service in February.

If an employee whose exemption expires and does not file a new form, withholding will be as if the employee were single, claiming no withholding allowances until the employee submits a new Form W-4 .

Please refer to the CT State withholding guide below for assistance in reviewing CT W4 election descriptors.

ESS9 CT State Withholding Codes Guide

The Department of Revenue Services offers a free informational packet called Is My Connecticut Withholding Correct? (PDF)* for employees who are uncertain of their tax liability.

Visit the Connecticut Department of Revenue Service website to verify correct withholding.

How to Read Your W-2 Form

Box 1: Wages, Tips, and Other CompensationYour reportable income for federal income tax purposes. This figure is calculated by subtracting your total before-tax deductions* from your total gross earnings.

Box 3 and Box 5: Social Security Wages and Medicare Wages

Your total gross earnings less or plus:

Less: Deductions for health and dental insurance

Less: Deductions for flexible spending accounts

Plus: Premium for taxable fringe benefits such as group-term life insurance over $50,000, tuition abatement, use of company vehicle, and others.

Box 10: Dependent Care Benefits

The amount deducted for a dependent care reimbursement account.

Box 12

CODE E: Your contributions to a 403(b) plan (tax-sheltered annuity)

CODE G: Your contributions to a 457 plan (deferred compensation)

CODE C: Taxable cost of group-term life insurance over $50,000 (included in boxes 1, 3 [up to social security wage base], and 5)